child tax credit 2021 october

IR-2021-188 September 15 2021. The full amount of the child tax credit for 2021 is refundable.

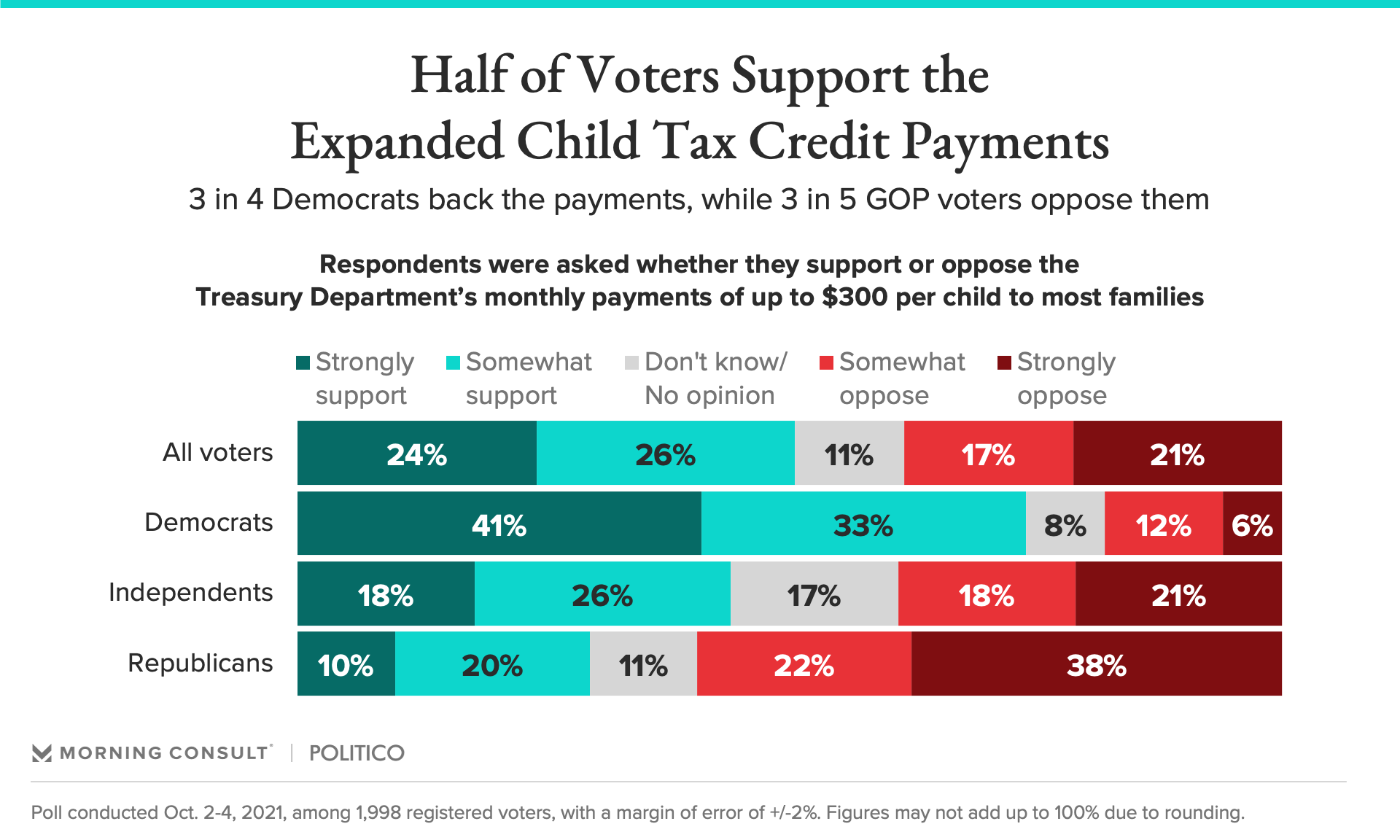

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

IR-2021-201 October 15 2021.

. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. The actual time the check. In 2021 the child tax credit was expanded to be worth 3000-3600 and the first half was sent early in staggered payments.

You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. That means parents who. 150000 for a person who is married and filing a joint return.

For children age 6 17 the tax credit is 3000. The guidance provides simplified procedures to allow eligible Puerto Rico CTC filers defined below who were not required to file a 2021 federal income tax return to provide information to the IRS to claim the CTC by filing a. There are two types of dependents in this case.

By August 2 for the August. 1 day agoPrior to the expansion and boost to the Child Tax Credit in the spring of 2021 under the American Rescue Plan the last revision of the tax code in 2017 the Tax Cut and Jobs Act TCJA doubled. So if you owe say 1000 in taxes the child tax credit would get you a 400 refund.

Non-refundable credits only help to lower the bill if taxes are owed Without the 2021 expansion only 1400 of the tax credit is refundable. There are a number of changes to the CTC in 2021 because of the American Rescue Plan Act of 2021 which President Biden signed into law on March 11 2021. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021.

1 day agoThis means in 2022 the child tax credit will be worth the regular 2000 it was years prior. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit.

The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments. 11 hours agoThe IRS on Friday provided guidance on how bona fide residents of Puerto Rico can claim the child tax credit CTC for tax year 2021. In previous years 17-year-olds werent covered by the CTC.

You could get it as a refund. The money is slated to go out in 2023 with tax refunds. October 15 2021 1242 PM CBS Chicago.

They are subject to different rules. Parents that had a child in 2021 can claim the child tax credit if they meet certain requirements. The Rules for 2021 Child Tax Credit.

October Child Tax Credit payment kept 36 million children from poverty. You may also get a tax credit for a qualifying relative. This year the 2000 will go to children 17 and younger with.

CBS Detroit -- The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15. The American Rescue Plan Act expanded the credit increasing the amount of the credit from 2000 to 3600 for babies born in 2021. The American Rescue Plan Act increased child tax credit payments so that families will receive 3600 per child under age six and 3000 per child from age 6 to 17.

This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families. This credit is 500. 112500 for a family with a single parent also called Head of Household.

Meaning you could claim the full credit even if it was greater than what you owed ie. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. The IRS is relying on bank account information provided by people through their tax.

For qualifying children under the age of 6 the 2021 child tax credit is 3600. The Child Tax Credit reached 611 million children in October and on its own contributed to a 49 percentage point 28 percent reduction in child poverty compared to what. The advance is 50 of your child tax credit with the rest claimed on next years return.

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. You can get the most up-to-date info about the 2021 Advance Child Tax Credit Payments anytime on IRSgov. Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children ages 5 and younger.

That comes out to 300 per month through the end of 2021 and. Ad The new advance Child Tax Credit is based on your previously filed tax return.

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Explainer What Are The Child Tax Credits Democrats Are Battling Over Reuters

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Child Tax Credit 2021 8 Things You Need To Know District Capital

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Did You File An Extension For Your Individual Tax Return You Have Until October 15 2021 To File Your In 2021 Accounting Services Small Business Accounting Irs Taxes

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit Schedule 8812 H R Block